1098-T Tax Information

Tax reporting:

1098-T forms are provided to students electronically no later than January 31st for the subsequent tax year.

Check out the 1098-T video tutorial on how to obtain your 1098-T electronically through the student center.

Don't See A 1098-T In Your Student Center?

If you do not have a 1098-T in your Student Center, your information may need to be updated.

Verify the following:

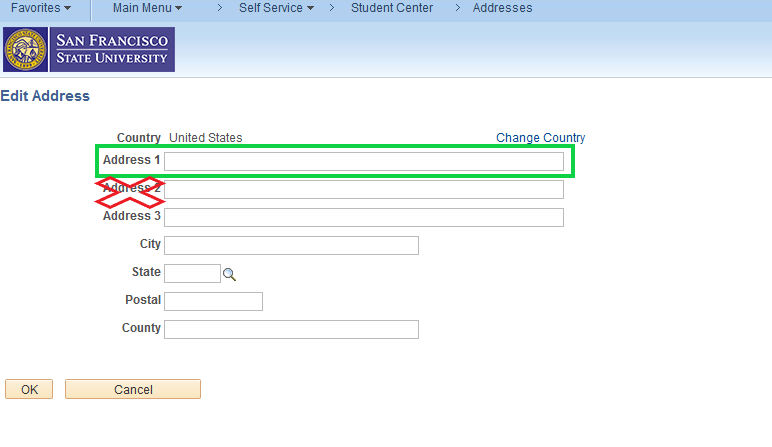

If you have identified a PREFERRED MAILING ADDRESS in your Student Center, make sure that the "Address 1" field is filled out and NOT the "Address 2" field.

A preferred mailing address can be listed if you do not want your 1098-T mailed to the PERMANENT address that was claimed with the Admissions Office when your application to campus was submitted.

To update your address:

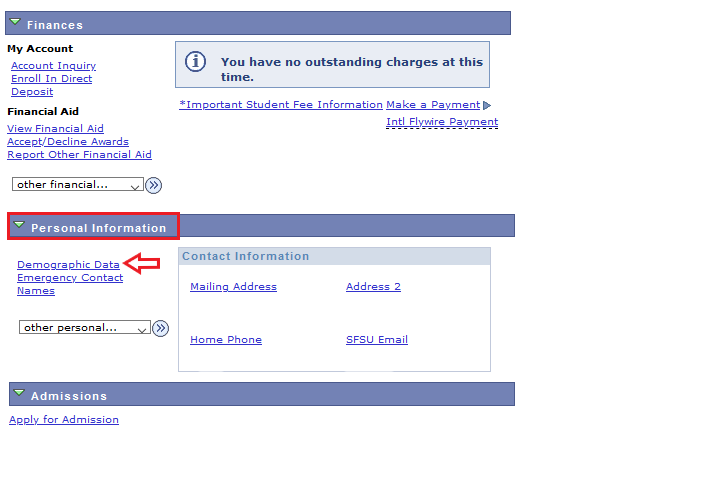

Look for the "Personal Information" section right under the "Finances" section in your student center.

Click the "Demographic Data" menu item.

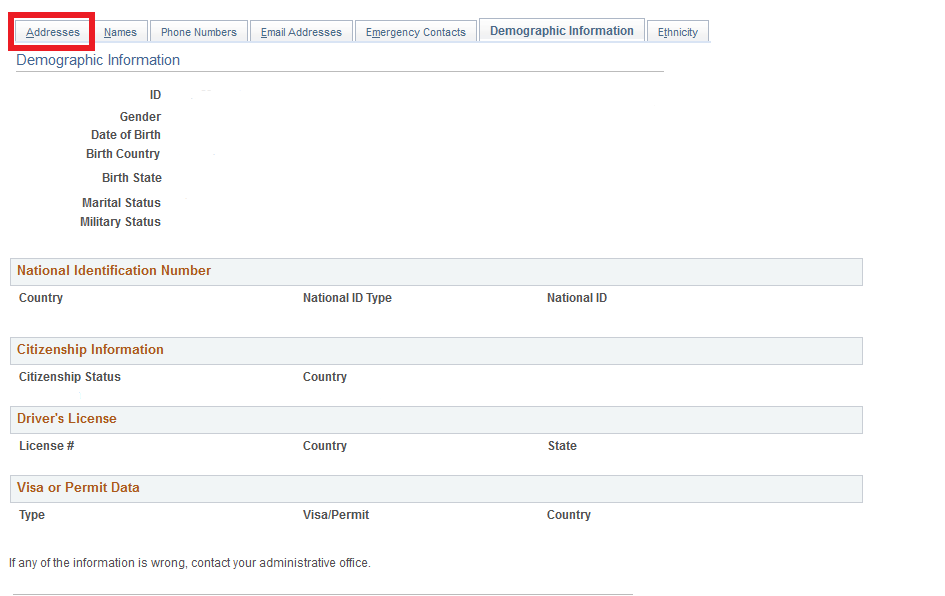

Click on the "Addresses" tab to make changes to your address information.

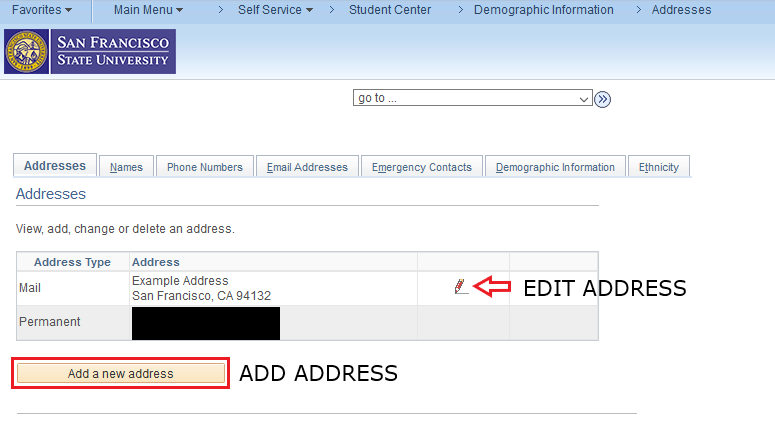

Make any changes to your address information on this page.

Make sure your ITIN or SSN number are current and updated with the Registrar's Office. Please visit their office at the Student Services Building Lobby to do so. If you have questions about updating your ITIN/SSN, please contact the Registrar's Office.

Make sure the amount being reported on your 1098-T is not expected to be less than or equal to $0. If you think there is an error, please contact the Bursar's Office at 415-338-1281 or by submitting a service ticket through the service portal.

Tax Relief Act of 1997

We strongly encourage students to seek professional advice regarding eligibility for this tax credit.

Hope Scholarship Tax Credit

Taxpayers may be eligible to claim a non-refundable Hope Scholarship credit against their Federal Income Tax.

The Hope Scholarship may be claimed by taxpayers who pay registration/tuition and other fees for attending college on a half-time basis or more.

This credit is designed to offset tuition costs incurred during the first two years of college.

This credit is available for tuition and required fees paid.

The credit may be reduced by financial aid awards including Pell grants, SEOG and institutional waivers, grants, scholarships, and other forms of tax-free educational assistance.

The maximum credit is $1500.00 per student.

For more information please contact the Internal Revenue Service.

The Lifetime Learning Credit

The Lifetime Learning Credit may be claimed by taxpayers who pay registration/tuition and other fees incurred for attending specified colleges.

The Lifetime Learning Credit is applicable to students pursuing post-secondary education to develop or improve job skills.

A family may claim up to 20% of qualified expenses or no more than $5,000.

Unlike the Hope Scholarship credit, which is based on an individual's enrollment status, the Lifetime Learning Tax Credit is family based.

The credit amount may be reduced by financial aid awards including Pell grants and SEOG and institutional waivers, grants, scholarships, and other forms of tax-free educational assistance.

See the IRS publication 970 for phase-out rules.

For more information please contact the Internal Revenue Service.

An extensive IRS question and answer publication is available at: